As to why Virtual assistant Finance is the Wade-To help you Selection for Experts inside the Southern area Colorado

Information Va Funds

Va loans was a crucial financial tool made to let veterans, service players, in addition to their household reach homeownership. This type of funds, backed by the U.S. Department from Pros Items, try to render a whole lot more obtainable and versatile mortgage choices than just conventional financing. In order to be considered, individuals need certainly to fulfill particular eligibility conditions considering https://paydayloanalabama.com/citronelle/ its duration of provider, obligations position, and character away from services. Additionally there is the brand new eligibility to own surviving partners not as much as particular requirements. This informative article examines some great benefits of a good Virtual assistant Loan, the brand new qualification criteria, as well as the software techniques within the Southern area Colorado.

Advantages of Va Mortgage brokers

Va lenders offer several benefits so you can qualified pros, service members, and their family. That key work for ‘s the no-downpayment requirements, that allows certified individuals to invest in 100% of your own house’s well worth instead of preserving having a down-payment. This feature can be significantly convenience the road so you can homeownership to have pros inside the Southern Tx.

- Another essential cheer is that Va money none of them personal financial insurance policies (PMI), hence saves extra month-to-month expenses typically needed for traditional loans whenever brand new advance payment was lower than 20%. This unique element makes monthly obligations alot more in check.

- Virtual assistant fund fundamentally have competitive interest levels and flexible borrowing from the bank criteria, that will result in good-sized much time-title deals. Once the government backs Va funds, loan providers guess shorter exposure, commonly allowing them to provide all the way down rates and much more lenient borrowing from the bank requirements than simply traditional funds.

Individuals take advantage of down settlement costs and certainly will prepay the financial without penalty. This flexibility might help experts spend less over the longevity of the borrowed funds and pay their houses ultimately whenever they need. These pros generate Virtual assistant money good choice for people that qualify.

Qualification to have Virtual assistant Loans

You can get a certification out-of Qualifications having an excellent Va financing for individuals who don’t receive a dishonorable discharge and you may meet the minimal active-duty solution standards once you offered.

- Difficulty, otherwise

- The convenience of the federal government (you must have served at the very least 20 weeks off a 2-year enlistment) or

- Very early aside (you really need to have served 21 weeks regarding a two-year enlistment) otherwise

- Reduced force, or

- Certain medical ailments, otherwise

- A support-linked handicap (an impairment connected with your own armed forces service).

- Lowest effective-responsibility provider to have solution members: at the very least ninety carried on months at once without some slack operating.

Virtual assistant Loan application Techniques in Southern Colorado

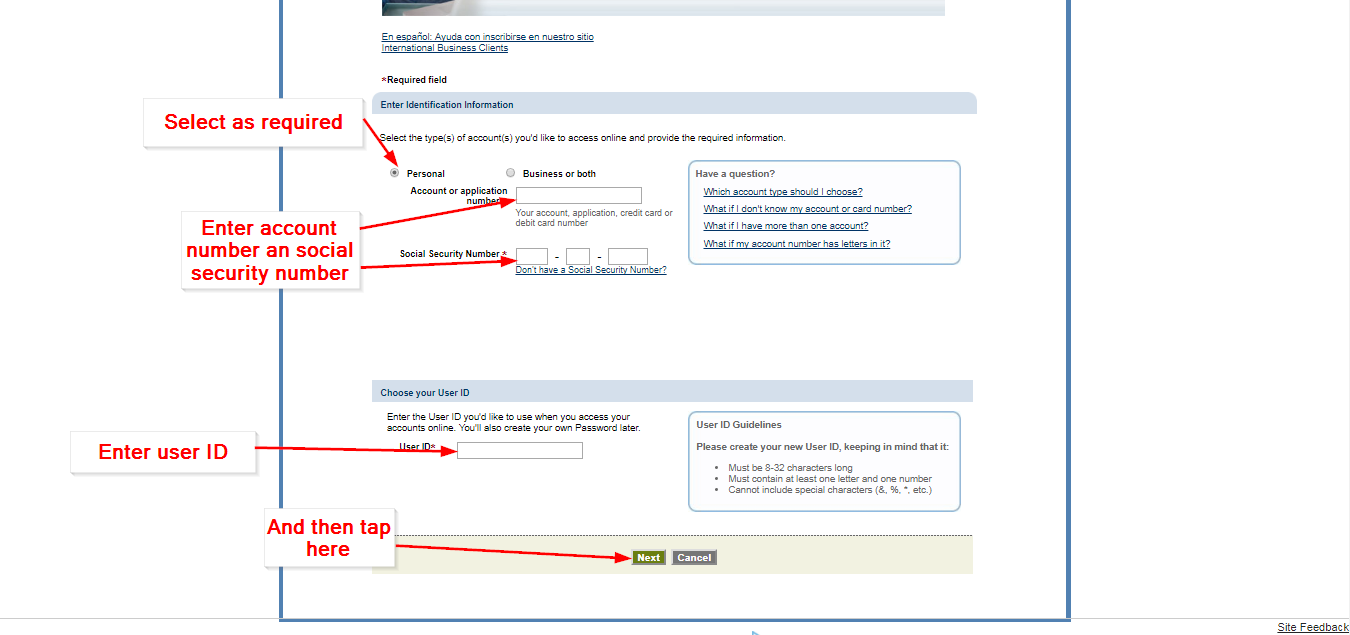

Obtaining a beneficial Virtual assistant mortgage inside the Southern Colorado pertains to several secret tips. The process begins with obtaining a certificate out of Eligibility (COE), which is crucial within the deciding the qualifications on the Virtual assistant finance during the Southern area Colorado. You should buy their COE from VA’s eBenefits portal or because of the coping with a prescription bank such as for example Higher State Financial.

Talk to a talented mortgage lender to be sure you have every the required documents able. This individualized guidance produces the program process much easier and much more productive.

Virtual assistant financing restrictions are different by venue, as well as in McAllen and you will nearby section, the limits are determined predicated on median home values. Understanding this type of limitations can help you recognize how much you might acquire. You can contact regional gurus instance Juanita Mendoza from the Better Condition Bank to own detailed information during these constraints and you can personalized direction.

Improving Their Virtual assistant Financial Benefits

Virtual assistant home loans provide multiple pros, plus no advance payment, zero personal home loan insurance rates demands, and you may aggressive rates of interest. These experts make it more relaxing for experts so you’re able to safe homeownership versus the financial traps one old-fashioned finance tend to introduce. Special programs and you can direction, eg Interest Protection Re-finance Fund (IRL) and Adapted Homes Provides, offer customized assistance for your requirements.

Pros is also use offered resources and you may direction programs to optimize its financing positives. If seeking to assistance from knowledgeable positives otherwise consulting homes counselors, delivering hands-on steps is facilitate an easier application processes.

Reaching homeownership since a veteran is not only a dream however, an achievable mission into right service and information. Leverage the Va mortgage advantages to generate a secure and you will comfortable future for your self and your members of the family.

Have you been a seasoned when you look at the South Texas looking to safer good domestic which fall? Realize why Virtual assistant Finance of Greater County Lender will be your own best services. Our individualized service and specialist pointers make processes simple and hassle-free. Find out more about Va Loans at Greater Condition Financial and then have already been now! Empower debt coming that have a bank one to truly cares in the your circumstances.

この記事へのコメントはありません。