Homeowners May prefer to Re-finance If you’re Rates Is Reduced

- Lincoln Property Authority

- Housing Base to possess Sarpy Condition

- Nebraska Housing Investment

- Nebraska Houses Developer Organization

- Nebraska Real estate professionals Relationship

- Huge Island Panel out-of Real estate agents

- Lincoln Connection out-of Real estate agents

- Omaha Organization regarding Realtors

- HUD: Nebraska

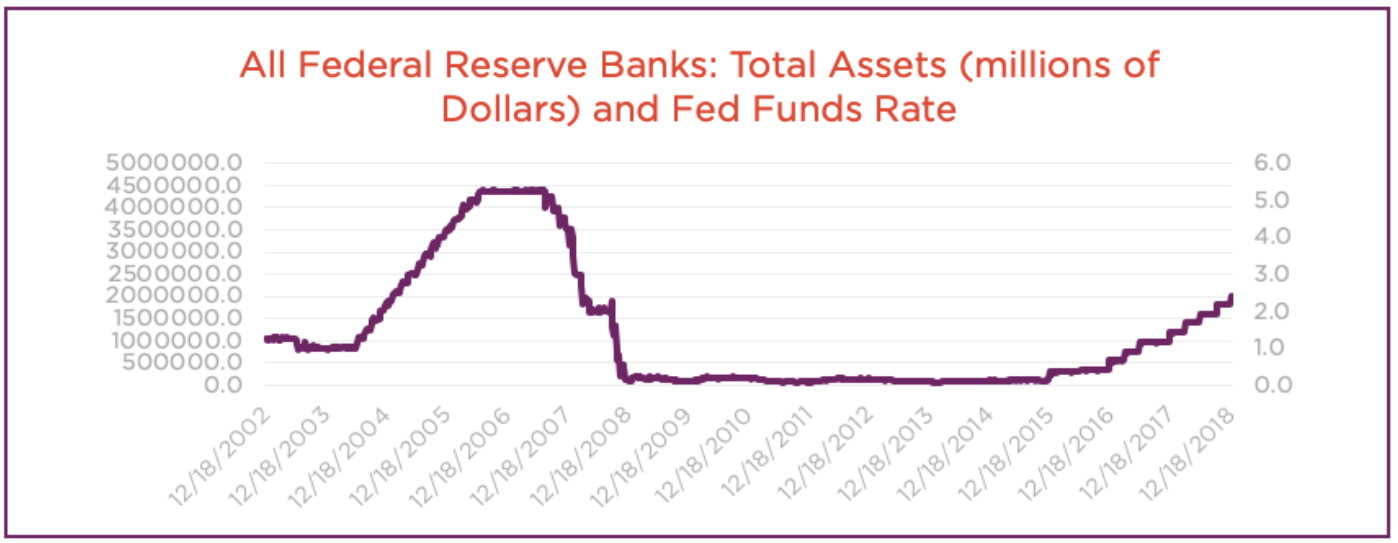

New Federal Set-aside has begun so you can taper the bond to buy program. Secure the present lowest cost and save well on your loan.

Discover what Your Qualify for

Because the , it ran with the an instant increase you to definitely come to gradually level away immediately after they peaked regarding the third quarter from 2011. The market industry continued that it a whole lot more progressive climb until the next quarter of 2013 when it had hook shed. It drop retrieved into another progressive rise one to plateaued on third one-fourth out-of 2015 through to the very first one-fourth of 2016. That it plateau finished, additionally the field visited go up once again in order to personal loans for bad credit Louisiane strike a different moderate plateau on the 3rd quarter out-of 2016 up until the fourth one-fourth out-of 2016. Once this plateau concluded, the business arrive at rise once again, and has started greater than it actually was till the construction .

Over the past 33 ages Nebraska’s homeownership speed have fluctuated between a minimal out of 66.6% into the 1988 and you can a top off 71.2% within the 2004. The new ownership rates has already established alternatively abrupt changes in directions, however, stays really above the federal mediocre. Ranging from 1994 and you may 1997 possession fell regarding 68% in order to 66.7% prior to jumping to help you 70.9% inside 1999. Control following slid in order to 68.5% when you look at the 2002 in advance of moving in order to a record top of 71.2% inside 2004. Next a special clear slide taken place, . Control following bounced to 70.4% in 2010 in advance of interacting with a minimal from 66.7% within the 2014. Within the 2016 possession endured on 68% in contrast to a nationwide average out of 63.4%.

All the economic stamina within this urban area is inspired by the latest production and provider areas. However, because it’s an investment town, the us government also takes on a massive role on the economic fuel also the training areas. Small economic aids is fund, publishing, healthcare, transportation, drug, i . t, while the railway. A few of these impacts produce an incredibly varied, healthy discount with many different available work.

The newest Sarpy County Historic Art gallery is a greatest visitors interest you to definitely showcases neighborhood history of the city. Somebody come simply to walk across the trails from the Fontenelle Forest Character Center or take regarding amazing views. Somebody also come towards area to experience the Midwest Pirate Fest each year.

Healthcare and you can studies compensate a couple of biggest local savings service to own Kearney. Shopping, transportation, provider, design, therefore the restaurant company also compensate high economic helps. This type of groups cause a very varied discount having a choice various efforts available.

Including traditional 30-seasons and fifteen-seasons fixed-price mortgage loans, loan providers bring a wide variety of changeable speed mortgage loans (ARM’s). When you are these tools have forfeit the the elegance within the recession, you can still find items where they give you the only path having a debtor so you can qualify. Safely planned (that is, that have rigorous limitations about precisely how far the interest rate is also fluctuate), particularly fund continue to be a legitimate means for individuals purchasing a home and begin building equity when you find yourself setting-up its borrowing therefore concerning be eligible for antique funds up on this new ARM’s conclusion. These finance give rates you to vary, due to the fact term ways. New Apr might be fixed to have an initial identity, like three, four, 7 otherwise ten years. Then the price changes with respect to the show regarding an excellent referenced list rates, always immediately following annually; it changes more frequently. The mortgage contract get state in more detail how many times brand new Annual percentage rate can alter, also it can likewise incorporate a speed cap to get rid of highest alter.

Mortgage Software within the Nebraska

When you look at the 2016 unmarried-family relations homes have been cherished at the $174,731 across the condition. Within a home tax research of just one.5% one triggered a review regarding $dos,614. From inside the Omaha the average evaluation towards unmarried-nearest and dearest house are $step 3,089. The latest federal average possessions taxation speed was step one.24% towards the a median single-family home value of $279,715.

- Omaha Houses Expert

この記事へのコメントはありません。