Choosing ranging from a cash-out re-finance versus HELOC, or finding other possibilities

Like many some body, the greatest financing We have try my personal family (that i now rent immediately following swinging to possess really works). This has been a huge wide range generator on short-time We provides owned it, which have an an3nualized get back alongside 31%. With influence, some really love can turn towards lots of prefer.

However to acquire and you may remodeling the brand new condo could have been a good investment up to now. However, i recently was basically asking me personally if for example the equity inside our home will be place so you’re able to its extremely active play with. I’ve been already a little worried viewing the significance tick up toward Zillow z-guess I get at no cost that have Individual Investment. I have over $200k during the guarantee all-in-one container (this new investment lower than try my personal home, very $475-277=

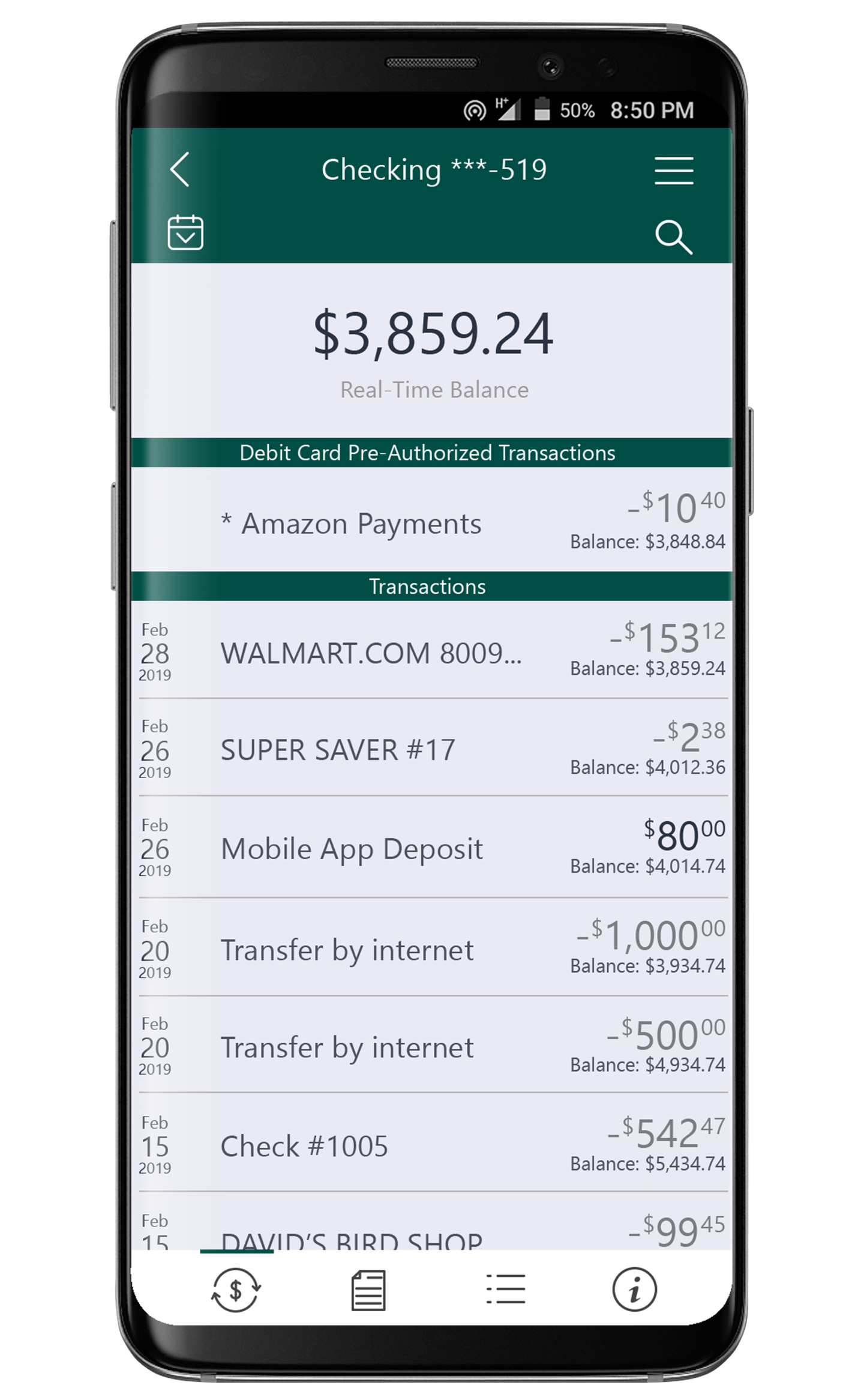

I prefer Individual Resource observe the worth of my condominium and all of my almost every other assets free of charge.

Can it be most useful complete to take out a few of the security in your house and you can invest they an additional leasing condo or in the stock market? Regrettably, the standard solutions getting opening one guarantee manage each other create toward payment and you may posting new leasing income to the the fresh bad.

Cash out re-finance vs HELOC?

The 2 old-fashioned alternatives for being able to access the fresh collateral when you look at the a house is a property Collateral Credit line (HELOC), otherwise Cash-Aside Refinancing. Cash-out refinancing try inactive easy: you take aside another type of financial for more currency than simply you already owe on your existing mortgage, you then pay your current home loan and keep the difference. Which have a HELOC, the financial institution has the benefit of a fixed credit line with a max draw. This means that, you can use to X amount, you feel the flexibility to help you acquire quicker. If you are contrasting a beneficial HELOC vs refinance, LendingTree has the benefit of home equity money, refinancing, and also opposite mortgages you could remark side by side.

Benefits and drawbacks of cash-aside refi

A finances-out refinance are deceased simple, that makes it very easy to take a look at. Many people cash out re-finance (or simply just refinance) when interest levels go down, since it makes it possible for retire the old financial during the large interest. It is also a little better to do than simply good HELOC as the there can be singular percentage. Generally, prices are also down with a cash-out refinance vs HELOC’s.

However,, a profit-away refi is only most you can if interest rates at a great macro top is below they were in the event that original home loan are removed. Given that rates have been ascending, which is unlikely. A profit-away refi will resume your amortization, meaning that you may be expenses a high portion of your financial to the attract than just together with your fresh mortgage (about beforehand).

Whether or not it every seems too state-of-the-art, how you can learn whether refinancing is sensible for your requirements will be to enter in your information into the my re-finance calculator.

Positives and negatives from HELOC’s

As you might think since they are for quicker terms than simply 30-year mortgage loans, pricing are often a little high which have good HELOC. But, a beneficial HELOC are recommended for someone who may have a current mortgage during the a low interest. Since the costs has grown since i have purchased my condo, a money-aside re-finance do rather boost my personal mortgage repayment, whereas a great HELOC carry out enable us to continue my fresh mortgage and just tack with the a new commission when you look at the an effective HELOC. One https://paydayloansconnecticut.com/branchville downside to a beneficial HELOC is the fact are means significant equity regarding the possessions, always towards the order out-of forty-50%.

Regrettably, one another refinancing and HELOCs try Obligations. It help the matter due to the financial per month, rendering it more complicated to earn a successful income when you are renting the condominium. The thing i actually need was selection so you can HELOC and you can refinancing you to definitely doesn’t boost my personal monthly premiums, but allows me take-out a few of the security We have on the condo.

$80k inside capital, while you are nonetheless preserving full command over the house and called for 20% minimum guarantee. After that, as i love to in reality promote brand new condominium downright, Section takes a portion of your own appreciation regarding condominium, and that i contain the other individuals just like the regular. This is actually the catch: should your value of the brand new condo falls, We incur the latest force of one’s losings as they simply engage partially. On the same token, it capture a keen outsized stake regarding the love. Unison and you can Point are comparable in terms of the fresh eventual income – you can find a chart away from Unison less than discussing how good product sales manage try various other field requirements.

There are many very important info to talk about. To begin with, Area ‘s the just one that will purchase a stake if you’re I’m leasing the fresh condominium away. Unison means that live in the home. Area only carries stakes to established home owners. Unison tend to mate with individuals who’re purchasing a property in order to offer guarantee in the initial pick, making it easier to stop PMI instead 20% off.

I’ve not a clue if this would be best to visit finished with a security purchases to suggest, although it does render a huge list of choices that allow particular extreme independency with just minimal efforts otherwise more obligations.

Second strategies: Keep track of all of your opportunities -together with your household- under one roof

Create a free of charge Individual Capital account, you might track all assets and you may possessions as you come across less than. Individual Money will help you to choose which place to go with your next financial commitment. It will actually allow you to keep track of their residence’s well worth that have a totally free Zillow z-imagine.

この記事へのコメントはありません。