Exactly what do I spend my PPP financing toward as a different company?

Quite often, money is king, proper? That is right, unless you’re trying show funds income. Should you get paid back cash regularly, it is vital to continue right records and statement it once you file taxation. If there is no legitimate checklist of one’s cash flow, you will possibly not have the ability to prove cash income. When customers spend your when you look at the dollars you need to let them have good bill. At exactly the same time, try keeping a duplicate yourself. If you’re getting ready for taxes you could potentially reference these types of invoices to see which their actual money try. While it may be appealing in order to imagine as if you performed not generate around you probably did, it can haunt you if you wish to show income. Even though you possess good credit, there are plenty of days where you might need to prove income.

On current pandemic, lenders are specifically wary about who they lend money to. They know most people are in need of assistance and will hopefully economically recover, but there is however zero ensure. As a result, loan providers was indeed asking for evidence of money out of negative and positive credit individuals to help them make smarter money.

Exactly what North Dakota title loans ND qualifies as the care about-employed?

When you find yourself care about-operating, that you do not benefit a pals or individual that will pay your an appartment salary or salary. At the same time, your potential customers otherwise payers, won’t subtract taxation from the shell out. Self-working workers are fundamentally freelancers, tradespeople, sales agents, and a lot more.

Independent builders may use their PPP financing on a good type of some thing, giving them specific independence and you can be concerned rescue. However, once they desires to go full PPP loan forgiveness, chances are they have to take at least 60% of finance to help with payroll expenses. As another contractor, this might indicate spending oneself. You could even purchase around 100% of your funds to blow oneself if you be considered and you can pursue the rules the right way. This is exactly difficult regardless if.

Outside of the payroll, there are many expenditures that you can to spend your PPP loan on nonetheless get the forgiveness. A few examples become:

Charges for staff member protection. This consists of PPE or any other functioning expenditures which can be expected to store relative to a few of the DHHS, CDC, and you will OSHA direction among others.

It is critical to browse what you are able to make use of this type of funds having before you can plunge from inside the and commence spending the brand new money. The purpose of these fund were to assist people exactly who battled into the start of pandemic and you may called for some assistance so they didn’t falter. It wasn’t intended for designers to make use of to your whatever it wanted.

How do i shell out myself having PPP mortgage separate designers?

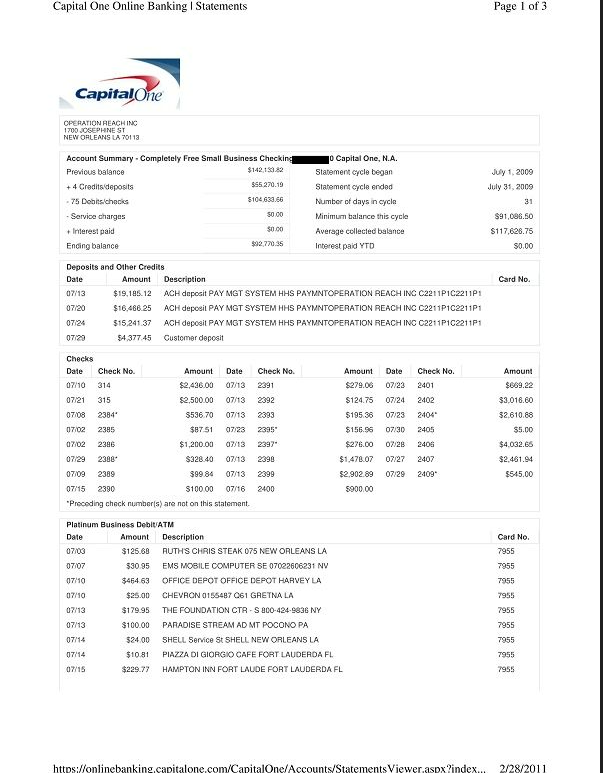

It is possible to get full forgiveness of your own PPP financing if the at the very least 60% of the financing are acclimatized to pay employees or even for most other types of payroll. Due to the fact an independent company, this means that you would have to spend you to ultimately create which work because you lack team. But not, there are still particular grey portion which might be and come up with contractors worried. Particular designers do not have a-flat fee agenda on their own that can be questioning how they will prove where in fact the money went. For individuals who took a great PPP financing and generally are a different specialist you really need to keep a record of cash moves to confirm the money is actually spent. If it is time for you consult forgiveness, you might find you to definitely that have a different sort of checking account for those finance is a good kick off point. Staying company and personal expenses independent is very important, especially for bookkeeping.

この記事へのコメントはありません。