How come Low-QM and you can Low-Traditional Mortgage loans Really works

To possess numerous individuals, Non-QM Funds and you will Low-Old-fashioned Mortgages depict the actual only real pathway in order to converting brand new think of home ownership on a real reality.

At Gustan Cho Couples, i accept many individuals fall outside authorities and old-fashioned mortgage financing standards. Acknowledging this particular fact, we now have based partnerships which have numerous wholesale mortgage lenders devoted to Non-QM Loans and you can Low-Antique Mortgages.

Our very own objective and you will purpose at the Gustan Cho Partners are to build all of the home loan product available on the market available for our very own consumers. I’ve install a standing of being a single-avoid home loan store.

Non-QM Money and you can Low-Antique Mortgages stay except that conventional mortgage alternatives ruled because of the regulators and conventional mortgage assistance. While you are the individuals follow strictly to predefined guidelines, Non-QM lenders provides better liberty, allowing conditions.

Whenever examining a non-QM mortgage software, underwriters evaluate the borrower’s total borrowing from the bank and credit history. When you’re guaranteeing new borrower’s capacity to pay-off remains important, non-QM lenders imagine some money provide outside of the antique spectrum.

What are Low-Licensed Mortgages

Non-QM loans and non-antique mortgage loans relate to financial selection that don’t comply with the quality criteria built from the authorities-paid companies (GSEs) instance Fannie mae and Freddie Mac computer. These lending products is tailored to prospects just who may well not see an average qualification conditions having conventional mortgages.

Non-QM funds generally element much more functional borrowing from the bank standards compared to the antique mortgages. They might and deal with option money papers tips, like financial statements, to evaluate this new borrower’s ability to pay off the mortgage. Also, non-QM financing would-be way more flexible in regards to the earnings conditions to possess qualification.

Investment Destruction or any other Alternative Loan Software

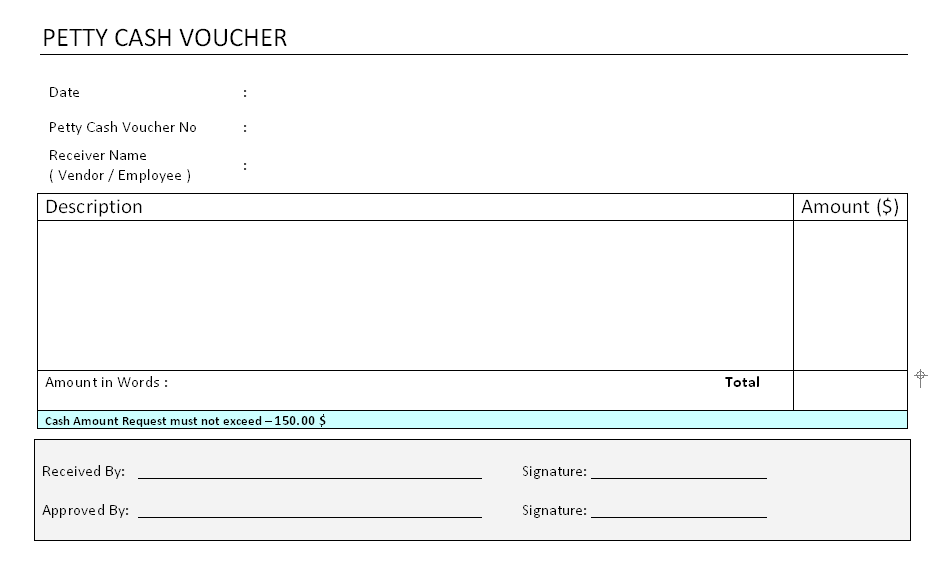

Some Low-QM funds think good borrower’s possessions whenever deciding eligibility, enabling those with extreme property but bizarre money source so you can https://paydayloanalabama.com/hayneville/ meet the requirements. Non-QM Money and Low-Conventional Mortgages get function focus-simply commission selection, making it possible for borrowers to expend entirely the interest getting a set period before starting prominent costs.

Versus antique mortgages, this type of financing fundamentally incorporate high interest levels. Particular Non-QM funds, like bank statement funds, no-doctor financing, no-ratio mortgages, DSCR funds, or other portfolio loan applications, none of them proof money for income tax aim. Balloon mortgage loans start with straight down monthly payments but require a lump-contribution payment (this new balloon) after a selected term.

Reverse Mortgages

Opposite mortgages allow homeowners, normally the elderly, to utilize their collateral within their property to don’t create a home loan payment up until the manager seats otherwise they offer its home. The primary equilibrium for the a reverse home loan develops eventually. You should be no less than 62 years old so you can meet the requirements for an opposite mortgage. This new earlier the fresh new debtor, the greater the borrowed funds-to-value which means old consumers can grab more cash-away.

Interest-Only Non-QM Financing and you will Non-Conventional Mortgages

For the an interest-only financial, individuals only pay attract having a designated months, immediately after which they start making prominent costs. Common Collateral Mortgage loans: Mutual collateral mortgages involve sharing the new prefer or decline off an effective house’s value for the bank. This can create homeownership more available, particularly for earliest-go out customers.

Subprime Mortgage loans

Subprime mortgages is actually an alternate identity to own non-QM finance. They often times include large interest rates and can even has varying cost. It’s important to note that when you find yourself such non-QM and non-conventional home loan solutions give self-reliance, possible individuals is always to very carefully see the conditions and you will risks of suing all of them.

Simultaneously, the loan surroundings is actually susceptible to regulating alter, therefore it is advisable to talk to an experienced home loan top-notch getting the essential up-to-day guidance.

Version of low-QM Mortgage Applications Available

Consumers using low-QM loans and low-antique mortgages certainly are the adopting the version of consumers: Self-working individuals who would like to explore one year out of lender declaration dumps and not play with the income tax production because of an excellent large amount of unreimbursed organization expenditures on the tax statements.

この記事へのコメントはありません。