Lenders generally need a good credit score, will targeting ratings over 700, so you’re able to safe advantageous home loan conditions

- Upkeep: With regards to the proportions and you may status of your investment property, they ount out-of repair and you may maintenance, just like the remaining the home within its most useful standing could be inside the best interest to preserve their value and you can attract potential renters otherwise buyers. Of several people don’t have the day, units or expertise to steadfastly keep up a complete assets that they try not to live in. Consequently, understand that managing a residential property may come having your own fair share regarding repair and you can company fees.

Just like any economic behavior, a property one to earns money has some advantages and disadvantages to keep in mind. Just before sinking several thousand dollars towards a this investment, it’s important to bring numerous items into account.

If you’re there are specific simple steps you need to, when you have any queries about your unique disease, it is required your consult with an appropriate or monetary elite group.

Feedback Yours Profit

An investment property may become a costly strategy. It is important to be financially able before bouncing when you look at the. Concurrently, proper obligations-to-earnings proportion (DTI), essentially less than 43%, is a must getting proving economic balance and you can cost capacity. Dealers also can need to promote proof of enough dollars supplies to cover down repayments, settlement costs and you can possible vacancies. Meeting these types of monetary standards is very important to possess being qualified to possess a mortgage for the a residential property and you can installing a substantial basis to have an effective successful owning a home campaign.

Save your self Having An advance payment

Rescuing to own down repayments is obviously an important part of family buying, and it’s especially important when selecting financial support properties. That is because lenders often demand stricter direction. If you are some one can purchase a first quarters that have as low as 3% off, many people looking to and obtain rental services have to generally speaking reserved a larger fifteen% to 20%. The fresh new down-payment in person influences the mortgage-to-well worth proportion (LTV), a switch grounds lenders envision whenever approving money. A top downpayment decreases the LTV, possibly improving mortgage words and you will rates of interest, however the complications is dependent on accumulating a critical initial share to meet bank conditions for those form of attributes.

Features Crisis Fund Offered

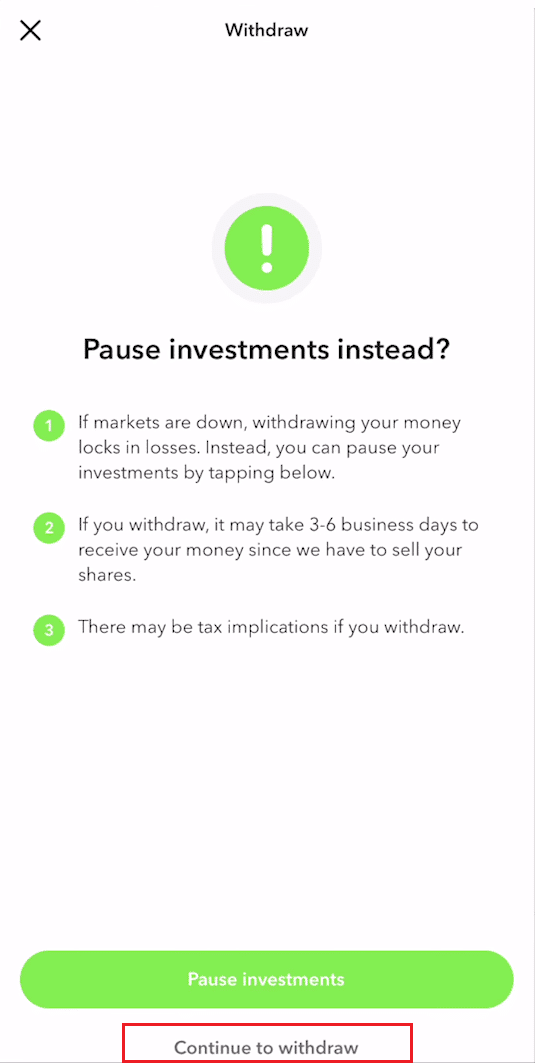

Investing in a residential property might be a beneficial endeavor that comes with many different monetary advantages. But not, the market industry will be unstable, and you should usually have crisis loans available. That have disaster finance allows dealers so you can decrease the risks for the unanticipated demands otherwise income dilemmas. Without enough savings otherwise bucks reserves, higher and you will unexpected will set you back regarding down repayments, closure, home improvements, legal charge and you may standard business expenses can result in financial distress. That have deals to fall back into the assurances the capacity to defense these types of costs instead of turning to higher-desire playing cards, money otherwise risking the increased loss of the house as a result of foreclosure or pressed product sales. An urgent situation fund coverage the general balance of your a house money.

Thought a good investment Companion

Going in on a house having a good investment companion could possibly offer several benefits, such as for example pooling info to afford a property, discussing maintenance can cost you and you may leverage combined experience getting pricing-productive fixes. Pooling savings makes it possible for brand new combined purchase of a house that might be if you don’t close to impossible physically. Shared repair costs and blend of family repair feel is also end in significant offers into elite group hiring costs. It is crucial to meticulously choose someone centered on trustworthiness, obligations and a hands-on method of repairs. In addition, thorough interaction and you can demonstrably laid out opportunities are essential having a profitable commitment, reducing the threat of judge difficulties and enhancing all round victory of your own investment.

この記事へのコメントはありません。