On both undergraduate and you can scholar peak, Black students is the most likely to obtain due to their studies

Models of Borrowing when you look at the College or university

California is not necessarily the simply condition in which it development retains, although pit inside credit ranging from Black colored graduate children and you may light graduate college students inside Ca is particularly higher, raising inquiries one scholar education during the Ca will be pressing a beneficial disproportionate display away from Black family to the loans.

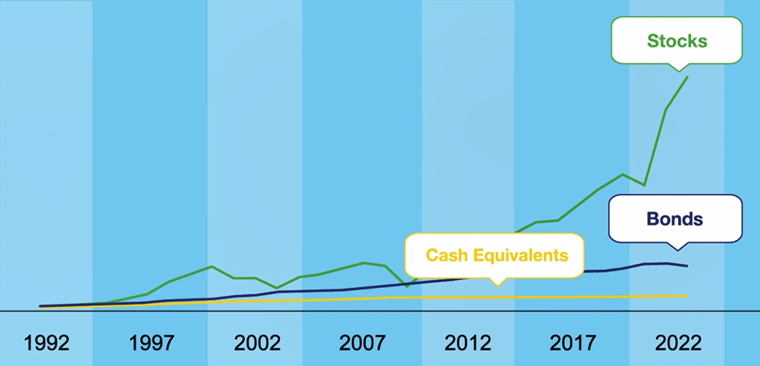

Shape 3

Mediocre cumulative funds by the graduation are higher to own California’s Black ($33,100) and Pacific Islander ($31,600) undergraduates, than the state’s undergraduates complete ($twenty five,400). Ibid. “> 25 Put differently, because of the graduation, California’s Black colored undergraduates not simply will be the most likely to own borrowed, as well as on average keeps lent big quantity.

Figure 4

Government-financed grant help applications, for instance the government Pell Offer plus the condition-financed Cal Offer, mainly work on undergraduate degree. No matter if California keeps a strong structure from student financial aid, we see that federal openings in the undergraduate credit considering race persevere from loan places Pierce the county. And you may security gaps in California arrive large in the scholar level, in which students be often kept to help you financially fend on their own in the place of government-financed support. You will be able one to undergraduate grant services programs such as the Cal Give help alleviate problems with holes by race from increasing far greater within student level. Unfortuitously, the evidence arises from air-highest credit certainly California’s Black colored scholar college students.

Life inside the Education loan Installment

TCF’s study of data of studies of households portrays you to, compared to California’s white families, student loan obligations is far more common and more pernicious to have California’s Black group, also to a lesser but still tall the quantity, California’s Latina group too. Contained in this statement, the newest terminology Latino/a and you can Hispanic can be used having deference so you’re able to how the dataset significantly less than desire identifies survey respondents. “> twenty-eight By secret procedures, the experience of Black and Latina individuals inside the repayment appears bad in the California compared to the rest of the nation.

Contour 5

Latina parents in the California features a unique character from student personal debt than just Black colored group, having crucial nuance one to raises its very own set of concerns.

- Latina houses with pupil debt are apt to have quicker stability than almost every other organizations from inside the Ca, shown in the united kingdom overall-in the event this won’t necessarily mean fees is simple for these group. Source: author’s data of information regarding Questionnaire of Household Business economics and you may Decisionmaking, through the You.S. Federal Reserve. Discover Profile nine on the companion statement . “> 30

- More Latina borrowers inside the Ca don’t have good college degree, versus that-one-fourth of white borrowers regarding the condition. Source: author’s analysis of information on Survey from Family Business economics and you will Decisionmaking, via the U.S. Federal Set aside. Look for Contour thirteen on mate report . “> thirty-two This is often associated with higher offers out-of Hispanic borrowers making university prior to it earn a qualification, including highest shares of moms and dad borrowers carrying debt to possess good child’s knowledge. On the Missing attempt regarding California homes, 11 percent from Hispanic home had obligations having a baby or grandchild’s knowledge, than the 6 percent away from light households. But not, new try dimensions are too little to state conclusively one Latina families’ odds of carrying parent-obligations try highest. Select Figure several and you may Dining table 13 throughout the lover statement . “> 33

- Around 70 % out of Latina property inside the California with student financial obligation earn lower than $75,000, well above the 47 % show to possess California’s light home with student loan obligations. Source: author’s data of information on the Questionnaire of Home Economics and you may Decisionmaking, via the You.S. Federal Reserve. See Figure 18 from the lover report . We favor $75,000 since it is a natural get down the fresh Shed data, that is advertised within the income supports. Once the a point of review, new Census Bureau, having fun with yet another questionnaire, finds out your average family income during the Ca is actually $84,907 into the 2021: pick Table S1901: Earnings in past times 1 year, through You.S. Census Agency, reached , obtainable at the “> 34 In comparison, Latina home having student education loans outside Ca apparently secure faster, however, while we can find, some highest income do not usually counter the highest costs regarding lifestyle that make fees challenging.

この記事へのコメントはありません。