Simple tips to Include Their Credit regarding Upcoming Destroy Shortly after Bankruptcy?

Specific law offices, including DebtStoppers, promote borrowing counseling services or discussion that have financial institutions on behalf of their customers. They might negotiate that have loan providers to repay debts, would fees arrangements, otherwise talk about debt relief solutions.

Legal advice and you may Information:

An attorney provide legal advice tailored on the specific state. Capable explain their liberties, loans, and you can alternatives for enhancing your credit, dealing with debt, and you may protecting yourself regarding unfair techniques.

Legal Shelter:

If perhaps your rights was in fact broken, such as unlawful repossession or harassment by financial institutions, a lawyer normally handle your case or take suit contrary to the unpleasant people.

It is vital to observe that while lawyers also provide beneficial direction with credit-associated issues, they may charges charge for their qualities. Ahead of looking to judge let, believe contrasting and seeing lawyers who specialize in user law, credit rules, otherwise personal bankruptcy to choose when the their assistance aligns with your requires.

A kick off point is through checking your own credit reports. You can obtain a totally free duplicate of your credit history away from all the around three biggest credit bureaus (Experian, Equifax, and you may TransUnion) to ensure you to definitely released costs is actually said accurately just like the “discharged in the case of bankruptcy” which have a zero balance.

To be sure your stay on tune financially, you should manage a funds and stick with it. It’s adviseable to generate an emergency finance to avoid relying on handmade cards otherwise financing during unexpected monetary setbacks.

When you’re rebuilding your borrowing from the bank, it is vital that you create all of the costs promptly. Constantly spending the expense promptly the most points in the rebuilding your own borrowing from the bank. For example power bills, rent, insurance, and you may one leftover expense. It can be useful to use reminders or automated costs so you can always never skip a deadline, that helps expose a confident commission history.

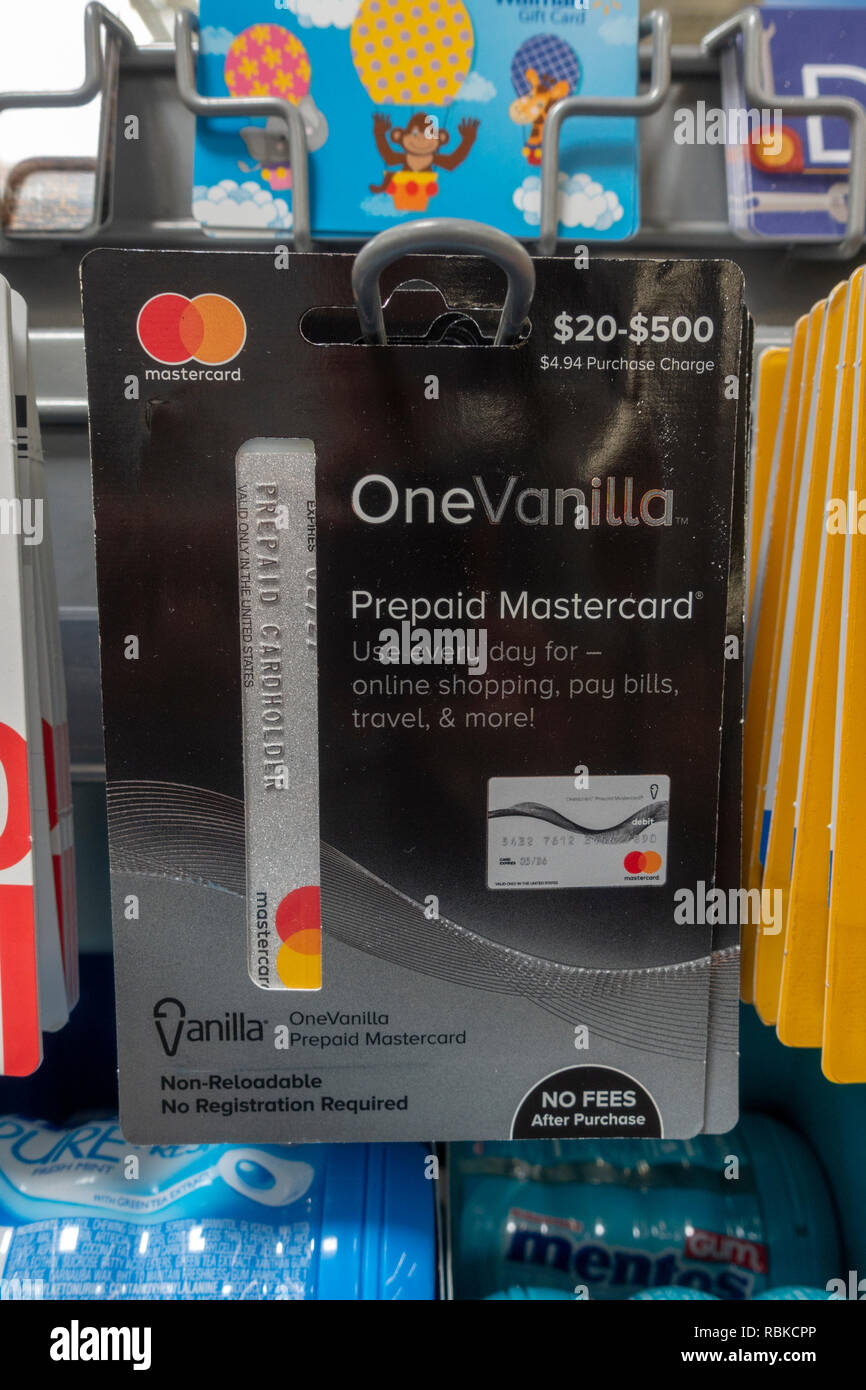

You can also discover a secured charge card. A secured bank card need a finances deposit since security, and this functions as your own borrowing limit. Make use of it having brief instructions and you will pay the balance in complete per month to display responsible borrowing from the bank use. You really need to look for a protected cards that have reasonable charges, profile to all three credit agencies, and also the potential to posting to an enthusiastic unsecured cards.

Shortly after case of bankruptcy, you should keep your own borrowing from the bank usage lower. You ought to endeavor to keep the borrowing use lower than 31% of readily available borrowing from the bank. To own secured credit cards, it means only using a little portion of their borrowing limit. On top of that, investing your own credit card stability entirely each month, can also be avoid interest charges and sustain your overall borrowing use reduced.

Stop higher-focus money and you may predatory loan providers. Avoid high-interest credit particularly cash advance, label finance, or any other higher-focus loans that pitfall you for the a pattern regarding loans and ruin their borrowing then.

A safe economic upcoming takes functions. Sit informed and you will educate yourself throughout the credit administration, budgeting, and personal loans and also make advised choices one help their borrowing-rebuilding efforts. You could consult a monetary mentor otherwise borrowing from the bank specialist in order to establish a personalized plan for improving your borrowing and you can maintaining economic balances.

By taking this type of proactive procedures, you can protect the borrowing from the bank regarding further wreck and you can continuously improve your financial status throughout the years.

Understanding the best term paper sites Impact from Bankruptcy proceeding into the Most other Economic Areas

Bankruptcy may have broad-starting effects toward certain areas of debt lifestyle beyond merely your credit score. Insights these affects makes it possible to better prepare for the difficulties and you may solutions that develop after declaring bankruptcy.

Post-bankruptcy proceeding, you may find it tough to be eligible for credit cards, unsecured loans, or mortgages. In the event you qualify for borrowing, you can even face high rates and less good terms and conditions due with the thought chance of the your own borrowing profile.

この記事へのコメントはありません。