The benefits and Drawbacks of employing an effective HELOC to own Mind-Functioning Consumers

Delivering a great HELOC to own notice-functioning people was a different sort of proposition. If you find yourself worry about-operating and looking a credit line, very carefully look at the advantages and disadvantages of employing your home equity. Knowing how this helps you ultimately is actually as essential as interested in brief-term choice.

Some residents can get have a look at HELOC qualifications once the straightforward. However, taking out people financing may have unique conditions. If you’re credit money as a personal-employed personnel, collect all the readily available suggestions before mode their plan in place. If you’re not sure where to start, schedule a consultation with our company. We had love the opportunity to take you step-by-step through how a beneficial HELOC you certainly will assist or harm debt wellness.

How a beneficial HELOC really works

A great HELOC functions as a rotating personal line of credit. That it monetary equipment uses the new equity in your home to supply financing a variety of programs. Whilst you is technically HELOC to have some thing, residents which find HELOCs have a tendency to generally utilize it getting:

Taking an effective HELOC is oftentimes appealing just like the you may be only paying the brand new currency that you apply, and additionally interest. It’s also possible to utilize the personal line of credit outside the household and you can withdraw of it as required in the mark months.

Does a beneficial HELOC require earnings verification?

Prospective HELOC borrowers need certainly to fulfill certain earnings certification. Whether or not bringing a beneficial HELOC to own self-functioning someone, there are standard qualifications. This usually comes with:

Loan providers have a tendency to mostly find proof of a reliable money. Shortly after your own draw period finishes, attempt to build uniform payments to simply help rebuild your house’s guarantee.

You will probably find that it is more challenging in order to satisfy earnings eligibility criteria whenever you are self-employed. As opposed to business staff, you cannot fill out the W-2 Function or shell out stubs. While you are securing a great HELOC getting mind-working reasons, you will have to gather the desired tax transcripts and you may financial comments even though you enjoys a stable earnings.

Is utilizing a HELOC if you find yourself worry about-functioning smart?

Getting mind-working experts, HELOCs are better to safer than signature loans. Into the a good HELOC, consumers bring their homes because guarantee. It means a lender can foreclose on the home if you don’t pay-off the line of credit.

Nevertheless the concern remains: When you get a good HELOC while you are mind-working? There’s absolutely no you to-size-fits-all the answer for borrowers. When you have a leading credit history, taking a good HELOC to possess care about-functioning need will make feel. The most important thing is that you myself verify the past number from maintaining a leading credit history. Additionally need to carefully review the month-to-month earnings and you will related property.

If you find yourself newly mind-functioning or if your earnings fluctuates, i prompt you to receive in touch. The specialist home loan specialists is very carefully browse your bank account. Our company is and additionally prepared to answer any queries you will probably have in regards to the ideal path to you personally moving on.

Utilizing good HELOC when you find yourself self-employed

Providers requires are among the most typical means mind-functioning gurus fool around with HELOCs. Delivering a americash loans Rock Creek Park great HELOC for care about-functioning necessities can differ based your business and you may community. You ent and you can provides, or perhaps make use of it to have independent costs.

No matter your own factor in seeking a good HELOC getting worry about-working requires, you’ll want financing in order to satisfy those people requires. Using a good HELOC to compliment your business is practical for individuals who is also pay-off the loan. As you prepare when it comes down to second procedures, thought all positives and negatives of using a beneficial HELOC getting self-working intentions.

More straightforward to be eligible for HELOCs: Delivering a great HELOC is typically easier than other financing solutions just like the its a guaranteed mortgage. You’ll need particular documents because you are notice-employed. However, loan providers still regard the mortgage as the safer.

Down interest levels: Spending some time working to improve your credit score. Paying people debts will help you to get access to the best cost.

The means to access extra money: For many who create your domestic guarantee, you may be in a position to obtain extra money which have good HELOC. You could both borrow doing 85% of the house’s joint loan-to-worth proportion.

Even more self-reliance through the installment several months: Shortly after the mark period ends, HELOC for notice-functioning consumers go into the fees period. That time lasts 15 to 20 ages, and you may repay the principal and you will focus throughout they.

Possibility of defaulting: A lender can foreclose on the home if the company drops on the hard times and you do not pay-off the borrowed funds. Your credit rating may also miss, that makes obtaining future financing much harder.

Varying interest levels: Even though you rating a low 1st speed, know that this may eventually boost. You may then must to evolve your own HELOC installment decide to a top borrowing cost.

Stacking costs try high-risk: Due to the fact a citizen and you can business owner, it is possible to wait just before stacking people debt into the best of an existing mortgage otherwise company financing.

Possibilities of having an excellent HELOC getting worry about-working borrowers

After you’ve related to our very own mortgage specialists, we’ll happily walk you through most other loan selection that meets debt needs. These may is:

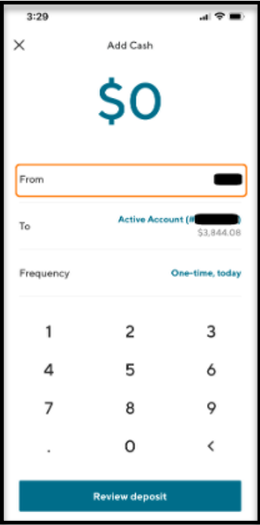

All in one Mortgage: So it mortgage lets home owners to use direct places to your dominant, hence cutting focus repayments from the tens and thousands of dollars over living of your financing. New All-in-one home loan in addition to functions as a checking account, making it possible for homeowners so you’re able to utilize family equity whenever they wanted with a convenient bank card. This will be an excellent choice for thinking-working some body whose money cannot continue to be regular all year round, and people who are motivated to pay back its mortgages when you are retaining accessibility home collateral.

Wanting financing is actually a primary action for citizen. Definitely consult a professional in order to settle to your a borrowing from the bank strategy that suits your unique needs.

この記事へのコメントはありません。