With regards to the brand new Teaspoon Financing Program, understanding the eligibility conditions and you may loan limits is a must

This part usually look into the many requirements and you will limitations relevant which have borrowing up against your own Agencies Automatic Efforts, offering facts off different perspectives so you’re able to create a knowledgeable choice.

It is essential to remember that as the Teaspoon Financing Program can be acquired to qualified people, this is not necessary and should end up being cautiously felt centered on private monetary circumstances

Are entitled to a tsp loan, you truly must be a working government staff or a person in the new uniformed characteristics. On the other hand, you’ll want at the least $step one,000 in your Teaspoon account while having maybe not reduced a tsp mortgage in the last two months.

The Teaspoon program allows you to use a minimum of $step 1,000 or over so you’re able to a total of $50,000 from your own Tsp membership. But not, the mortgage number try not to surpass the latest vested level of the Agencies Automatic Efforts, in addition to one income for the men and women efforts. Its well worth bringing-up that if you features a fantastic Teaspoon loan, the maximum amount you could acquire was smaller by a good balance.

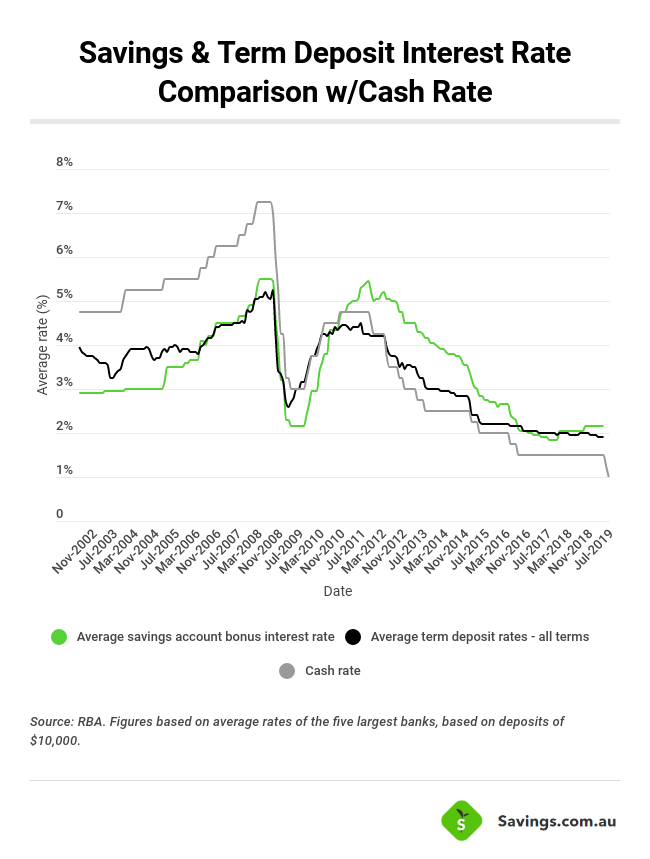

When considering a TSP loan, it is essential to compare it with other loan options available to you. conventional loans from banks, for example, ounts and repayment terms. However, they often come with highest rates of interest. On the other hand, TSP loans have fixed interest rates, which can be advantageous if you are seeking stability and predictability in your loan payments.

You to great benefit regarding Teaspoon finance is the fact that notice installment loans online in Florida paid off goes back in the individual Tsp account, in place of to a lender. Also, the interest rates to possess Tsp financing are generally lower versus most other financing possibilities, making them a less expensive choice for individuals. As well, Tsp financing not one of them a credit score assessment, which makes them available to people who have faster-than-perfect credit scores.

Before making a decision to take a tsp mortgage, it’s very important to consider particular items. First and foremost, borrowing from the bank from the senior years account form decreasing the amount of money designed for prospective progress. This will effect your own much time-label deals and eventually your retirement income. Secondly, for people who get-off government provider prior to paying the mortgage, the the harmony will get due within 3 months. Incapacity to settle the borrowed funds this kind of situations can result in taxation and you will penalties.

Determining the best option for your borrowing needs requires careful evaluation of your financial goals and circumstances. If you require a large loan amount or longer repayment terms, a traditional bank loan might be more suitable. However, if you prioritize lower interest rates, simplicity, and the ability to pay the mortgage through payroll deductions, a TSP loan can be an appealing choice.

Knowing the eligibility requirements and you will mortgage constraints of your Teaspoon Loan System is extremely important when considering credit against the Agencies Automated Benefits. Examining the advantages and drawbacks, evaluating along with other financing possibilities, and you can considering your individual economic situations will assist you to create a keen advised choice one to aligns together with your quick-term and you may enough time-term goals.

5. Applying for a tsp Mortgage

Regarding borrowing from the bank against your own Service Automatic Contributions courtesy the newest Tsp Financing Program, the process of trying to get financing can appear a bit daunting at first. Yet not, that have a clear comprehension of the fresh new tips in it, plus the pros and cons from the choice, you possibly can make the best decision about be it the proper one for you.

step 1. Eligibility: The first step within the trying to get a teaspoon loan are choosing the qualifications. Becoming qualified, you truly must be a dynamic government worker or a person in the newest uniformed functions. Additionally, you’ll want at least $step one,000 on your Tsp membership and possess perhaps not paid off a previous Teaspoon loan entirely within the last 60 days.

この記事へのコメントはありません。