Zero-Off USDA Lenders vs FHA against Conventional 97

Just how Affordable Is USDA Home loans?

The us Agencies from Farming (USDA) loan, known as the brand new (RD) loan, needs no down-payment and is offered to lower-credit individuals.

Demand for these fund keeps growing since buyers know the advantages. Over 166,000 household put an excellent USDA loan when you look at the financial season 2015 alone, according to the company.

Buyer desire isnt alarming. The newest USDA financing is the only available today to have homebuyers as opposed to military solution record.

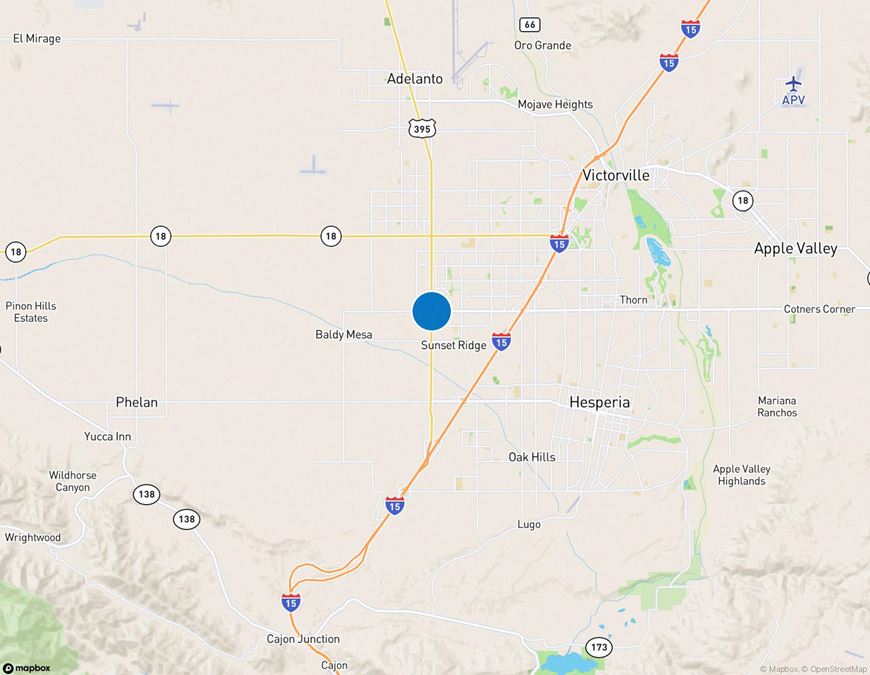

Rural Development funds arrive based on precise location of the property, maybe not lives sense. Specifically, USDA people you would like simply to find a property inside the a rural city because the defined because of the USDA. Nevertheless definition of outlying is quite liberal: on the 97 % of all of the U.S. property size is approved.

USDA Cost And Home loan Insurance rates

USDA loans allow 100% investment, meaning no deposit becomes necessary. This is because USDA fund are covered, otherwise backed, from the You.S. authorities.

Zero down payment does not always mean buyers shell out large prices. USDA funds render similar otherwise all the way down cost than just exists which have FHA otherwise conventional fund.

USDA loans, not, has actually a small disadvantage compared to Old-fashioned 97 because it include an initial payment of just one.00% of one’s amount borrowed. The fee is not required when you look at the dollars in the closure. Alternatively, the quantity was wrapped towards prominent equilibrium and paid down through the years.

USDA Will set you back Versus FHA and you will Traditional 97

The fact that USDA loans don’t need a down-payment preserves this new family customer a hefty matter initial. This decreases the timeframe it will take a buyer to help you be prepared to pick a property.

Other low-down-payment alternatives, instance FHA financing or a traditional 97, still require a deposit away from 3.5% and you may 3% correspondingly.

To the mediocre home cost of regarding the $250,000, a beneficial USDA borrower will want https://paydayloanalabama.com/sylacauga/ $8,750 quicker upfront than an enthusiastic FHA borrower.

USDA loans incorporate a high harmony, on account of reduced down-payment, but that is slightly counterbalance because of the straight down pricing and a lot more affordable home loan insurance policies.

Down-payment

- USDA: $0

- FHA: $8,750

- Old-fashioned 97: $eight,five-hundred

Loan amount

- USDA: $252,five-hundred

- FHA: $245,471

- Old-fashioned 97: $242,five-hundred

Monthly Dominating, Focus, And you can Financial Insurance policies

- USDA: $step one,280

- FHA: $step 1,310

- Conventional 97: $step 1,385

Just remember that , such payments do not include almost every other will set you back instance assets taxes and you will homeowner’s insurance policies, and are generally centered on test, rather than live, pricing and you may ple shows that USDA demands an equivalent payment per month compared to the FHA, without having any step 3.5% deposit.

Whilst the USDA loan amount is actually highest due to zero deposit, monthly installments are the same otherwise lower than the other selection.

Monthly payment is far more important than dominating equilibrium for the majority buyers. All the way down monthly can cost you make USDA mortgage inexpensive having parents which have rigid costs.

Lowest Credit rating For A great USDA Financial

USDA mortgage brokers keeps other professionals as well as low initial and month-to-month costs. They also have versatile borrowing criteria as compared to most other loan versions.

Having a USDA financing, home buyers simply you desire a credit rating out of 640. Federal national mortgage association guidelines place the minimum credit history on 620 to own a normal 97, even in the event loan providers tend to normally lay a top the least 640 to help you 680.

Truly the only prominent loan system with less necessary credit rating try FHA, which simply means a credit score out-of 580.

USDA Money Restrictions Guarantee Accessibility For Reasonable Earners

USDA mortgage brokers are available to customers from the or less than particular income limitations. So it direction is determined positioned to ensure the application form is used because of the those who want to buy most.

However the earnings limits getting an excellent USDA was good-sized. Is USDA qualified, our home visitors produces around 115% of your area’s median earnings. Whenever children out of five, here are the fresh annual money restrictions for the majority of biggest elements:

Large group are permitted and then make far more. Like, a household of 5 or even more regarding the Los angeles city makes $129,600 nonetheless meet the requirements.

What exactly are Today’s Cost?

Due to the fact USDA funds was backed by the united states Service from Farming, they provide masters you to definitely other companies cannot, such as for example short initial can cost you and you can super-lowest cost.

The new sagging standards, easy affordability and 100% financial support provided by good USDA financial succeed an emotional alternative to conquer.

Get a beneficial USDA rate quotation, that comes that have a keen assets and you will earnings eligibility see. All the prices is entry to the live credit scores and you can a custom monthly payment guess.

*The latest repayments shown a lot more than guess a good 720 credit rating, solitary home, and assets in the Washington County. Conventional 97 PMI costs are supplied by MGIC Ratefinder. Money dont include property taxation, homeowner’s insurance, HOA dues or other can cost you, as they are predicated on analogy APRs that are supposed to have demostrated a comparison, maybe not currently-readily available cost. Decide to try APRs utilized are listed below: USDA cuatro% APR; FHA step 3.75% APR; Conv. 97 cuatro.25% Apr. Seek advice from a loan provider right here to have a customized price and Apr quote.

この記事へのコメントはありません。